Don't miss our holiday offer - up to 50% OFF!

The Self-Banking Era: How Stablecoins Turned Cross-Border Payments Inside Out

2025: The Year Money Went Global

Andreessen Horowitz’s State of Crypto 2025 report landed with a clear message — crypto isn’t the sideshow anymore.

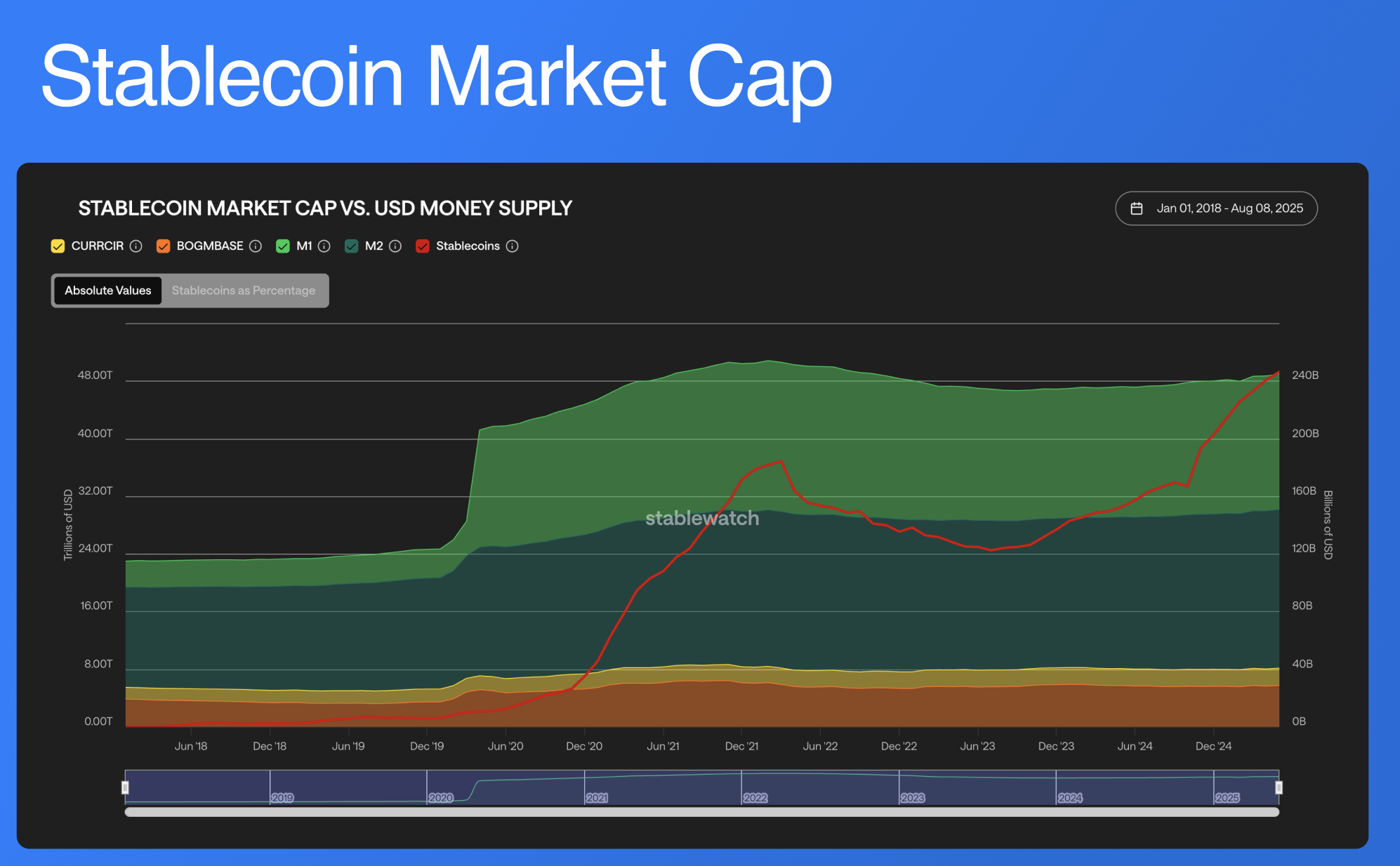

Stablecoins are now powering $46 trillion in yearly transactions. That’s not speculation. That’s real economic activity — money moving between people, platforms, and countries faster than any card network ever could.

What’s happening isn’t just a tech story. It’s a shift in how the world moves value.

And it’s creating something we call self-banking — a new model where individuals and businesses own their financial infrastructure instead of depending on layers of middlemen.

From SWIFT to Stable: A Global Upgrade

For decades, cross-border payments relied on systems like SWIFT — slow, costly, and exclusive. A freelancer in Lagos might wait days to receive a wire from London. A designer in Buenos Aires could lose 8 % of her income in conversion and fees.

Stablecoins changed that overnight.

A transfer that once took three banking intermediaries and $40 in fees now costs less than a cent and settles in seconds.

The a16z report calls this “product-market fit” for digital dollars — the moment crypto rails finally outperformed traditional banking rails at scale.

VaultLeap exists inside that moment.

We give users real USD and EUR account details that behave like normal banking — clients can wire you as usual — but under the hood, funds settle as stablecoins. The result? Your payment lands globally, instantly, and in your control.

Who’s Already Building on These Rails

When companies like Visa, Mastercard, PayPal, Stripe, and Shopify start rebuilding their payment stacks around stablecoins, you know the shift has gone mainstream.

According to a16z’s State of Crypto 2025 report:

- Circle went public with a market cap above $50 billion.

- Stripe acquired stablecoin platform Bridge and wallet company Privy, and launched its own payments blockchain, Tempo.

- Visa rolled out stablecoin-linked cards through its Tokenized Asset Platform.

- Mastercard partnered with Circle to enable onchain transfers and stablecoin settlement.

- PayPal introduced “Pay with Crypto” for cross-border commerce.

- Shopify added stablecoin support to Shop Pay.

- BlackRock, Fidelity, and JPMorgan each launched or integrated tokenized funds and crypto investment products.

It’s not just crypto startups anymore — it’s the financial system itself getting rebuilt with stablecoin infrastructure at the core.

What Self-Banking Really Means

Self-banking doesn’t mean going off-grid or hiding money on a USB stick.

It means owning your wallet, controlling your access, and using banking tools that speak the same language as the internet.

Platforms like VaultLeap make this feel familiar:

- You sign in with an email, not a seed phrase.

- You receive and hold money in a secure wallet that only you control.

- You can send, split, or withdraw directly to a local bank — no exchanges, no delays.

In this setup, you’re not just a customer of a bank — you’re the bank, powered by infrastructure that’s finally caught up to how people actually work and live today.

The Cross-Border Workforce Is Leading the Charge

According to a16z’s research, active crypto users rose by 10 million this year — with the fastest growth in Argentina, India, Colombia, and Nigeria.

That’s no coincidence. These are countries where traditional banking systems are slow, expensive, or restrictive.

Stablecoins became a lifeline for freelancers, creators, and startups getting paid globally.

VaultLeap was built with this exact group in mind.

When someone pays you in USD or EUR, we automatically settle it in stablecoin — no Coinbase account needed. You can hold, send, or convert it back to fiat whenever you like.

It’s what cross-border payments should have been all along: transparent, fast, and user-owned.

Why This Matters

2025 marks the first real year where crypto feels invisible — it just works.

Stablecoins run in the background while users experience what feels like ordinary banking.

The implications are huge:

- Small businesses in developing markets can now invoice in USD without needing a U.S. bank account.

- Global teams can pay salaries across continents in seconds.

- Creators and freelancers can finally skip the currency roulette and get paid at true market value.

That’s not the future of finance — it’s the present, and it’s spreading fast.

The Takeaway: Banking Is Becoming Personal Again

We’ve entered an era where you hold the keys to your financial life.

Not the bank. Not the exchange. You.

VaultLeap was designed for this shift — bridging the regulated banking world with the freedom of self-custody.

It’s what happens when stablecoin infrastructure meets real-world usability.

If 2025 is the year the world came onchain, 2026 will be the year people realize they’ve already been banking that way — quietly, confidently, and globally.

VaultLeap is a financial technology platform, not a bank. Payments and banking services are provided